Stay Financial Savvy with our Credit Score Tool!

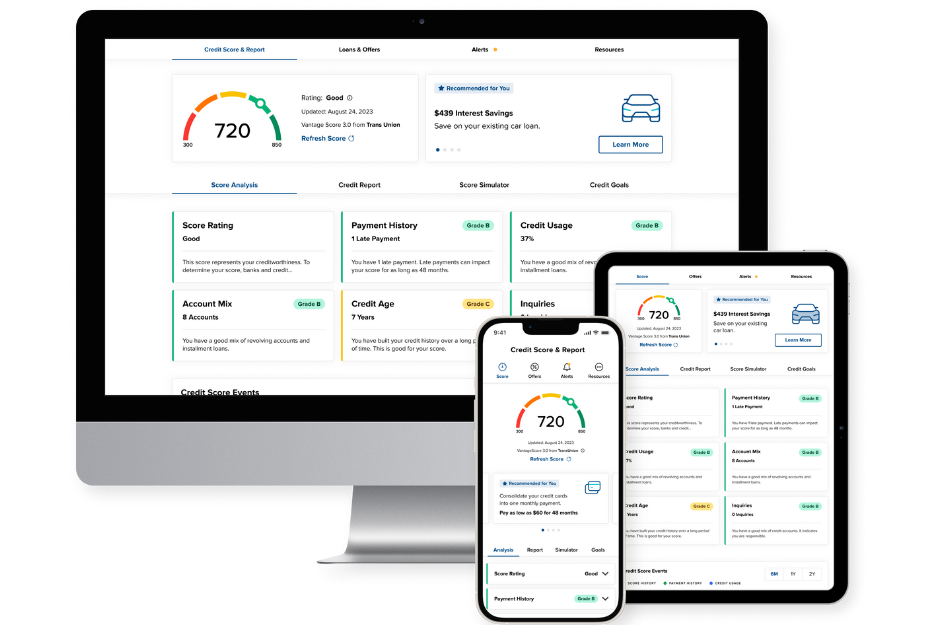

Staying on top of your credit has never been easier! With one powerful tool, access your credit score, full credit report, credit monitoring, financial tips and education, and personalized offers from AAACU.

You can do this ANYTIME and ANYWHERE for FREE.

Enjoy features like:

- Daily access to your credit score.

- Set goals for improving your score.

- See what can affect your score with a credit score simulator.

- Real-time credit monitoring alerts.

- Assess your financial situation with a financial check up.

- Personalized credit report.

- Special credit offers from AAACU.

- And so much more!

Access your credit score and report by logging into Online Banking or the Mobile App today!

Credit Score FAQs

Yes! It’s also important to note that no credit card information is required to register.

Members can enroll through AAACU's online banking and/or mobile app.

- Online Banking - Members will see a widget next to their Accounts dashboard. They simply click the widget, agree to the Terms & Conditions, and submit their permission to enroll.

- Mobile App – On the Accounts screen, customers will be able to scroll to the bottom of their accounts and see a Credit Score tile. Then click the tile and agree to the Terms & Conditions to submit their permission to enroll. There is also a shortcut to Credit Score on the app's Home Page!

Yes! Members can navigate to the “Start A Dispute” button at the very bottom of the Credit Report page. They can file a dispute directly with TransUnion using this link.

Yes! On the Credit Report page, members can click “Download Report” in the top right corner. A PDF version of their full report and Alpena Alcona Area Credit Union offers will generate. They can choose to print or share their report electronically from there.

Yes. On the Resources tab, members can select “Profile Settings”, scroll to the very bottom, and select “Deactivate Credit Score Account.” Once unenrolled, members can choose to reenroll at any time through online banking or the mobile app.

Yes! Members can receive credit alerts, monthly notices, and general messages from Credit Score. These can be set up in the Alerts tab.

In Credit Score, members can manage their email notifications by navigating to the Resources Tab, selecting “Profile Settings” and change their preferences under Email Notifications. They can also change their subscription settings at the bottom of emails they receive.

If a member does not log in to online banking or the mobile app for 120 days, their Credit Score would go inactive, and they would be unenrolled. To reenroll, they would follow the normal enrollment procedures and they would regain access to their profile information.

Vantage 3.0

Yes. Three major credit reporting bureaus—Equifax, Experian, and Transunion—and two scoring models—FICO or VantageScore—determine credit scores. Financial institutions/lenders use different bureaus, as well as scoring models. Over 200 factors of a credit report may be considered when calculating a score, and each model may weigh credit factors differently. Hence, no scoring model is completely identical but should directionally be similar.

Every 24 hours. Member profiles will automatically be refreshed every 7 days if they haven’t refreshed within that timeframe to ensure they’re always seeing up-to-date information.

No. Checking credit scores on Credit Score is a “soft inquiry”, which does not affect their credit score.

Credit Score is a credit monitoring tool we provide to you at no cost to learn more about how your financial decisions impact your credit score. You can expect your score to be different because we consider additional credit factors in your loan application that are not available in this tool that may result in a different score.

Credit monitoring tools like Credit Score use scoring models like Vantage Score 3.0 to display your credit details. There are additional credit factors we consider when reviewing your loan application by using a FICO scoring model. The use of different scoring models is why you see a difference in your scores.

No scoring models are identical but are directionally similar. If your score goes up based on your credit activity in Credit Score, you might see an increase in the scores we pull for loan applications as well.

More than one-third of consumers have found at least one error on their credit report. Errors on credit reports are not uncommon, so staying up to date and reviewing your credit report is a must. Credit Score offers a variety of benefits including a download of your credit report to review anytime, anywhere. Common errors on credit reports include personal information like a wrong name or address or account information like an account you don't recognize. You can dispute any errors you might see right within the tool!

That’s great that you’re staying on top of your financial health by monitoring your credit! Credit Score is built into the safety and security of our online banking and mobile banking platforms. Credit Score doesn’t allow other third-party lenders to see any of your credit profile data like some other credit monitoring tools do to allow them to provide you with offers for their products. Instead, you’ll only see valuable products and services from AAACU, so you know when you have a savings opportunity at your fingertips!

Great news! It doesn’t affect your credit profile or score in any way! Credit Score performs a soft inquiry when you enroll or refresh your credit profile instead of a hard inquiry like when you apply for a loan. Your credit score will only experience a hard pull if you apply for an offer.

To enroll, you first have to be logged in to AAACU’s secure online banking or mobile app. Your credit information is never shared with third parties. While you may see offers from AAACU based on your credit profile, the credit union does not have access to your credit report from Credit Score unless you apply for an offer with us.

YES! We encourage you to enroll so that you may closely monitor your credit profile and report any errors in a timely manner. Remember that if you see an offer you’d like to apply for, you will need to remove the block or freeze prior to submitting your loan application so our lending team can review your request.

If you happen to see an error on your credit report, you can file a dispute directly with TransUnion at the bottom of the Credit Report page by clicking on “Start a Dispute”. You will need to create an account or log in to TransUnion’s website and then submit your dispute. TransUnion will begin their research and if they find that the error is valid, they will update your credit profile and pass the error information on to Equifax and Experian. You may need to follow up with the other two bureaus to ensure your errors have been corrected.